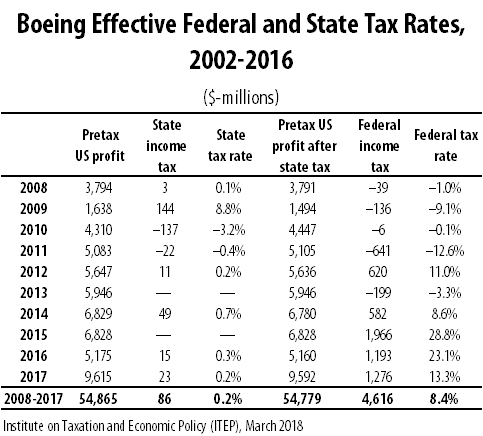

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut – ITEP

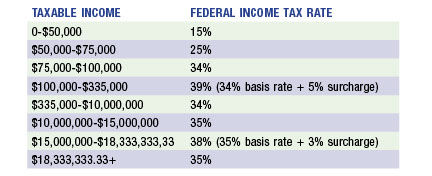

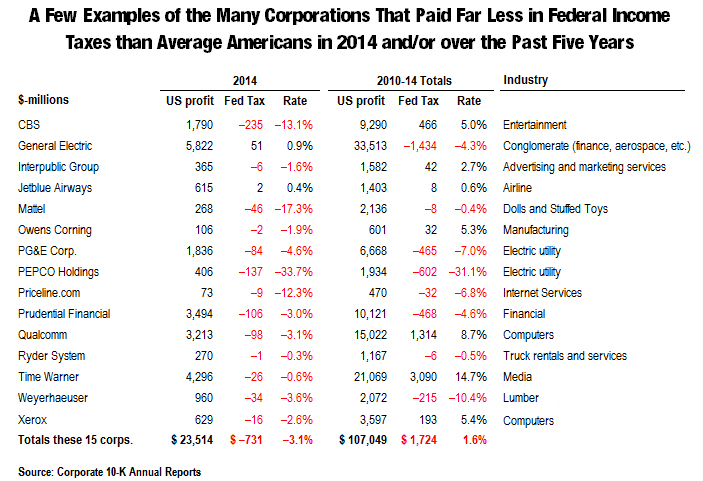

Fifteen (of Many) Reasons Why We Need Corporate Tax Reform | Citizens for Tax Justice - Working for a fair and sustainable tax system

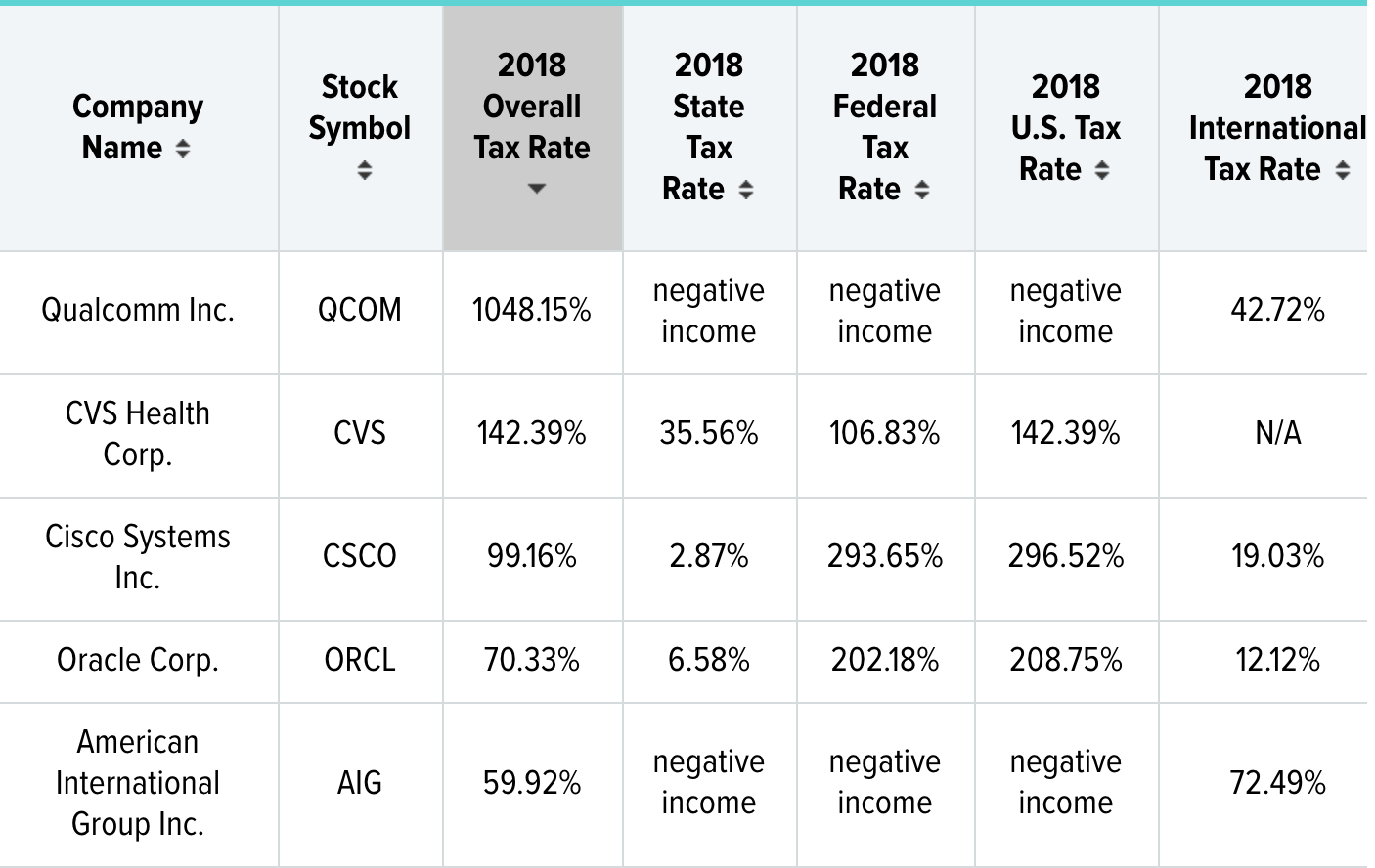

10 companies in the Fortune 500 with lower income tax rates than the average American family - Economic Opportunity Institute Economic Opportunity Institute